- Details

- Written by Gordon Prentice

We live off London Road in Newmarket and every summer grey bearded pensioners become part of my life.

London Road runs through a residental neighbourhood but over the years it has turned into a heavily trafficked arterial. I could live with that were it not for the noise.

Sitting astride their over-chromed Harley Davidsons I hear the pensioners coming long before I see them.

They arrive at my intersection, phut, phut, phutting, gunning the engine, revving up three or four times to make sure we know they are there. Then they gently move off at a stately 10-15kph. Roaring as they go.

They could be blowing smoke in my face or giving me the finger.

Old Men going Nowhere

Worse. They are not going anywhere. These old men are cruising the Town.

Why don’t they just disappear? Preferably out of Ontario.

The seniors on Harley Davidsons are the most intrusive and irritating. But close behind are the boy racers whose standard-issue cars are modified to make us notice them. Giant mufflers. Rap with an ear-splitting thudding bass.

Toronto's Noise Review

Earlier this week Toronto City Council told us they intend to conduct a “noise review” next year and they will be asking the Province to address the problem of excessive vehicle noise and illegally modified vehicles.

They are also looking at new regulations which would allow the Council to launch

“a noise activated camera/automated noise enforcement pilot project”.

That is terrific news.

Enforcement Blitz

The City Council has also requested:

“the Toronto Police Services Board conduct additional joint vehicle enforcement blitzes with bylaw enforcement and explore equipping police officers with sound level meters to support enforcement of vehicle noise. The City will also educate licensed car repair facilities that muffler cut-outs, straight exhausts, gutted mufflers, Hollywood mufflers, by-passes and similar devices are prohibited under the Highway Traffic Act.”

This makes my heart sing.

Similar initiatives are happening in progressive cities around the globe. And, increasingly, here at home people are are saying enough is enough.

The Grey-Beards and the Boy-Racers have had it their own way for far too long.

It’s time to put a sock in it.

This email address is being protected from spambots. You need JavaScript enabled to view it.

- Details

- Written by Gordon Prentice

On Tuesday night, the Toronto Star’s Robert Benzie broke the story that Doug Ford is planning to curb the role of municipal councillors in Toronto and Ottawa while giving the Mayors of these two cities greatly enhanced powers.

This is to be a trial-run with other cities such as Mississagua, Brampton and Hamilton in a second wave.

I suppose we should be grateful for small mercies. Ford could have embarked on a wholesale municipal reorganisation, amalgamating and abolishing for no particular reason. Just to show he can do it.

We don't know the details of the Toronto and Ottawa pilots which, apparently, have not yet been considered by Ford's Cabinet.

Not mentioned

Ford's "Strong Mayors" plan wasn't even mentioned in the Provincial election less than two months ago.

Instead, the Progressive Conservatives ran a largely content-free campaign.

We are told that Doug Ford and Dawn Gallagher Murphy will get it done: They will (1) rebuild Ontario's economy (2) build highways and key infrastructure (3) work for workers (4) keep costs down and (5) plan to stay open.

This wasn't a platform. Just a bunch of slogans.

We are told their policy offering was all in the 2022 Budget - the one that hadn't even passed when the legislature was dissolved for the election. And still hasn't.

Get it done!

Our newly elected MPP, Dawn Gallagher Murphy, who was personally appointed by Doug Ford, is a perfect example of this new breed of politician who trades in vacuous slogans. She says nothing substantive and talks in happy generalities. During the election she refused to engage with the other candidates and stayed away from the debates.

On Wednesday I emailed Dawn asking for an appointment to discuss the plans for super-charged Mayors. I shall report back on our conversation.

Easily Distracted

Ford just goes where the fancy takes him. He is, by nature, capricious and impulsive. Under his leadership, the Progressive Conservatives have no rigorous policy making process.

Policy is whatever Ford decides it is, from moment to moment.

He blind-sided us all in 2018 when he announced in the middle of the municipal election campaign that the membership of Toronto City Council would be cut by half.

He launched a municipal review in 2019 to cut red tape and identify savings but backed off from making any changes. He didn’t really know what he wanted.

Ford axed election for Chair of York Regional Council

In 2018 when Ford was cutting the size of Toronto City Council he shamefully axed the planned direct election of the Chair of York Regional Council.

I gave evidence to the Bill Committee at Queen’s Park in 2016 when Kathleen Wynne was considering legislation for the direct election of Regional Chairs. The Liberal Government picked up Chris Ballard's Private Members Bill and put it into law - only for the measure to be reversed by Ford who stuck with the status quo.

I reminded the Bill Committee that the population of York Region is bigger than five Provinces and three territories and is one of the fastest growing areas of North America yet its Chief Executive, Wayne Emmerson, is not directly elected by the voters at large but by his 21 Council colleagues

A decade ago, I recall Professor Robert MacDermid from York University explaining why the Regional Chair should be elected by the voters at large.

An election for the Regional Chair would force the voters and politicians to confront the huge infrastructure and transport issues that are currently neglected, forgotten or, even worse, swept under the carpet.

We need to engage the public in these big issues. And what better way than to have an election for the Chair of York Regional Council.

Dancing to their tunes

Here in Newmarket, the election campaigns of our Regional Councillor, the ineffective Tom Vegh, are bankrolled by developers and he dances to their tune.

But how many people know that Vegh is in the pockets of the developers?

And, in an election that will be woefully under-reported, who is going to tell them?

This email address is being protected from spambots. You need JavaScript enabled to view it.

- Details

- Written by Gordon Prentice

Earlier this week Statistics Canada released the latest batch of results from the 2021 Census, including information about families, households, and marital status. It is the third of seven release dates for census results.

What do the figures tell us about the Town where we live?

Newmarket population is up 4.4% between 2016 and 2021. There are now 87,942 of us. Aurora is up 11.9% and East Gwillimbury is up a staggering 44.4%. It is the fastest growing municipality in the country.

The average age in Newmarket is 41. Higher than Aurora at 40.9 and much higher than Canada as a whole, 39.2.

Living Alone

There are 5,535 people living alone in Newmarket - or 18.3% of all households compared with Aurora at 17.1%; East Gwillimbury 13.9% and Canada as a whole 29.3%.

The single person household became the dominant form of household in Canada for the first time in 2016. It has now crept up from 28% in 2016 to 29.3% in the 2021 census.

Roommates

The fastest growing household type was the so-called “roommate” category – people living with others who are not related (as spouses or partners). In Newmarket there were 2,470 people living with non-relatives or 2.9% compared with Aurora’s 1.9% and East Gwillimbury’s 2.1%. In Canada as a whole it is 4.2%.

The soaring cost of housing is clearly one of the factors driving this phenomenon.

In its commentary on the census the Globe and Mail observed:

These “roommate households” grew 14% since 2016 compared with 4% growth among households of a family without additional people. This was driven by people aged 20-34 whose roommate household status grew by 20% since the previous census.”

Well-off

Generally speaking, Newmarket is a well-off place – though with pockets of deprivation and low incomes. The median after-tax income of households in Newmarket in 2020 was $95,000 – way above the all-Canada figure of $73,000 but lower than Aurora and East Gwillimbury which are both on $102,000. (The median is the mid-point between the highest and lowest household incomes.)

Statscan says

“After-tax household income is the measure of income that most closely captures the overall economic well being of Canadians, reflecting how much money families have to support their consumption, investment and savings needs.”

And the very well-off

21.2% of Newmarket households have household incomes of $150,000 or more compared with 26.1% in Aurora; 22.8% in East Gwillimbury and 12.4% in Canada overall.

COVID-19

32.2% of adults in Newmarket received COVID 19 emergency and recovery benefits compared with 30.9% in Aurora; 31.2% in East Gwillimbury and 27.6% in the country as a whole. The median benefit across Canada was $8,000 with Newmarket on $8,500; Aurora on $9,000 and East Gwillimbury on $8,000. The maximum that could be received was $14,000.

These pandemic payments cushioned the impact for people on low incomes.

Low incomes

The thresholds for low income depend on household size. For a single person household low income after tax is below $26,503.

11.1% of Canadian households are deemed low income with Newmarket and Aurora both on 7.5% and East Gwillimbury on 6.6%

This email address is being protected from spambots. You need JavaScript enabled to view it.

- Details

- Written by Gordon Prentice

The debate on social media at York Regional Council on 30 June 2022 has received less coverage than it deserves.

Background: At issue is whether elected officials whose salaries come out of public funds have the right to arbitrarily block constituents from reading and commenting on their Tweets and social media posts without giving reasons. (The key definitions of blocking; muting; spamming; trolling and Open Social Media are here in the proposed new guidelines.) The Regional Clerk’s commentary is here. You can watch the debate here.

After reviewing the case of Carmine Perrelli, the boorish and aggressive regional councillor from Richmond Hill, York Region’s Integrity Commissioner recommended the Region’s Code of Conduct should be revised to incorporate social media guidelines.

In the event, the recommendations were rejected by a margin of 13-8 after a debate in which it soon became clear half the members didn’t know what they were talking about. (You can read the debate, and view it, by clicking “Read More” at the bottom).

For the inclusion of social media in the Regional Code of Conduct:

Jack Heath (Markham)

Mayor John Taylor (Newmarket)

Joe Li (Markham)

Mayor Tom Mrakas (Aurora)

Mayor Steve Pellegrini (King)

Mayor Margaret Quirk (Georgina)

Mayor David West (Richmond Hill)

Joe DiPaola (Richmond Hill)

Against the inclusion of social media in the Regional Code of Conduct:

Linda Jackson (Vaughan)

Jim Jones (Markham)

Mayor Iain Lovatt (Whitchurch-Stouffville

Carmine Perrelli (Richmond Hill)

Gino Rosati (Vaughan)

Mayor Frank Scarpitti (Markham)

Tom Vegh (Newmarket)

Mayor Maurizio Bevilacqua (Vaughan)

Regional Chair Wayne Emmerson (elected by Council not by voters at large)

Mario Ferri (Vaughan)

Robert Grossi (Georgina)

Mayor Virginia Hackson (East Gwillimbury)

Don Hamilton (Markham)

Perrelli the victim

Carmine Perrelli was his usual blustering self, complaining he was the victim of an Integrity Commissioner who had found him guilty of contravening a policy "that did not even exist".

Of course, this is precisely why the Integrity Commissioner recommended the Regional Council revise its Code of Conduct - to incorporate guidelines on social media.

Perrelli claims that 50 complaints about him had been referred to the Integrity Commissioner who found only three violations!

Taking us all for fools, Perrelli says he has never blocked anyone:

“My staff decide who needs to be blocked.”

He believes Integrity Commissioners are getting above themselves and need to be taken down a peg or two. And Codes of Conduct need to be revamped to

“take away the ability to use it as a weapon”

On Codes of Conduct, York Regional Council came very late to the party, only agreeing one in 2019 after the Province insisted all municipalities should have one.

Frank "slippery-slope" Scarpitti

The sonorous and long-winded baritone, Markham Mayor, Frank “slippery-slope” Scarpitti, always had reservations about a Code of Conduct. But, then again, he had reservations about broadcasting meetings of the Regional Council. He felt people could manipulate the images of councillors and use them “politically”. He believed an audio-feed was good enough.

Scarpitti is the Regional Council’s leading “slippery-slope” theorist. If you want to tax empty properties then whatever next? The authorities will soon be deciding if you are selfishly occupying property that is too large for your needs. Scarpitti says you better watch out:

“If someone's an empty nester, a single widow in a single family home, are we going to start saying that's way too much space for someone and they should be taxed because they're not fully (occupying it)?”

Scarpitti’s meandering observations equate quaint, old-fashioned paper newsletters and flyers with weightless interactive social media where opinions can be exchanged in nano seconds.

If the Code of Conduct is amended he is wondering where is it all going to end. Will big brother be telling him he can’t put some comments straight into junk? Or telling him how to interact with people? Or whether he should return a phone call? His laboured arguments are absurd but, as usual, he is heard in respectful silence.

They don't have a clue

Newmarket’s John Taylor tells his colleagues what is becoming painfully obvious. Some of them didn’t have a clue what blocking means in practice.

“Blocking means your constituents can’t see you – your comments, thoughts and ideas as an elected official.”

And Taylor believes, as I do, that is wrong.

Newmarket’s Deputy Mayor, the ineffective Tom Vegh, who is so often on the opposite side of the argument to Taylor, tells us:

“Social media is very much like a newsletter. We publish it more frequently and nobody would suggest that anybody, be it a friend or a foe, has a right to put things in your newsletter.”

Straw Man

This is Vegh setting up a straw man. No-one is suggesting for one moment that anyone wandering in off the street should have a column in Vegh’s newsletter.

He says a social media policy is unnecessary at regional level. Not too long ago many of his colleagues were arguing the Region didn’t need a Code of Conduct on the grounds it would only duplicate what was already there at local level.

Tom Vegh is a huge disappointment. Vegh, with a Twitter following of 884, tells his colleagues there is no reason for constituents to put their comments on his site:

“except for the fact that I have a few thousand followers and that person may only have a few dozen followers. So they want to get their point across more broadly. So in other words piggy back and get a free ad in the Toronto Star.”

"I don't even have a staffer"

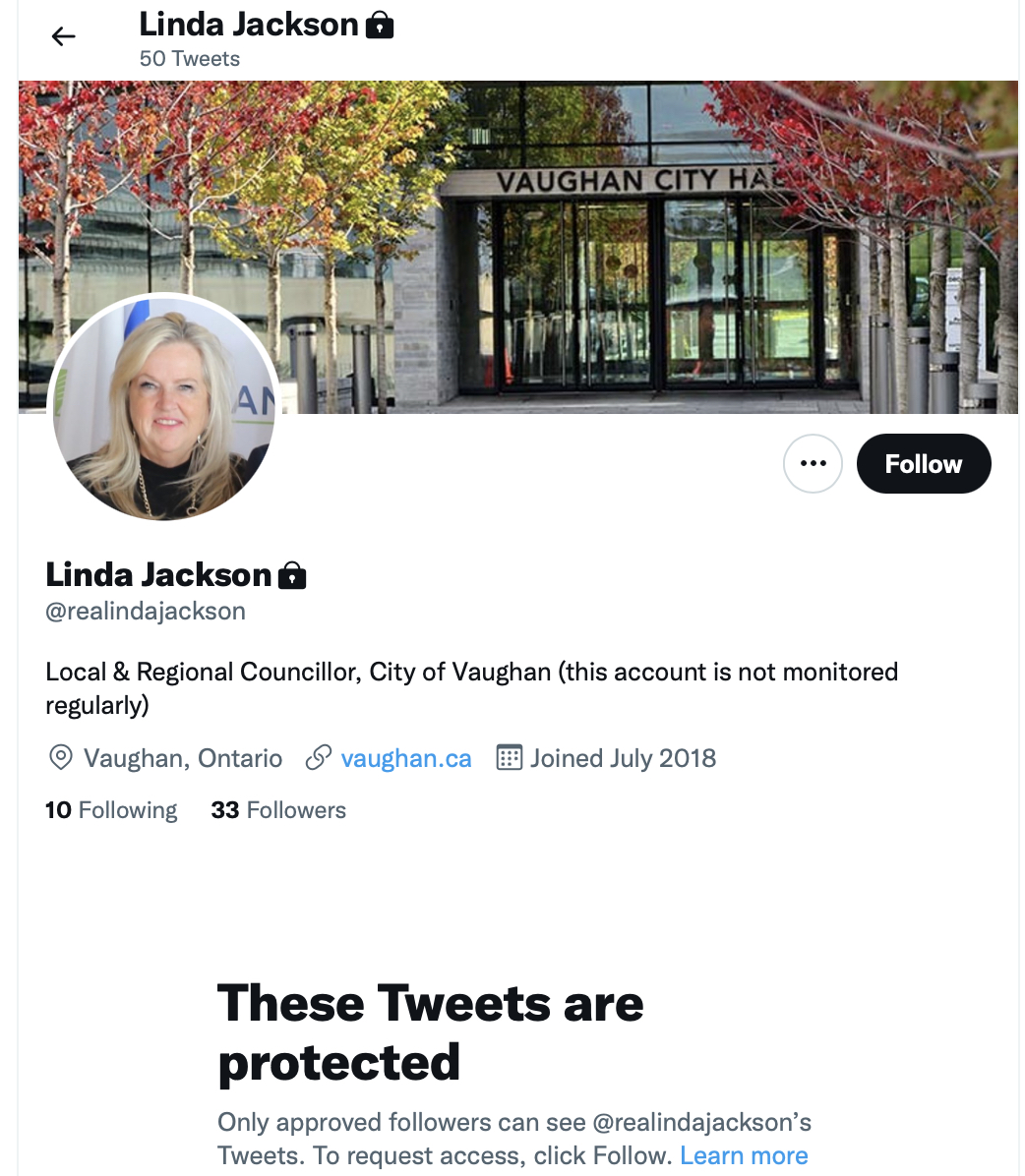

Markham’s Linda Jackson, the developer’s friend, says her social media sites are personal – but hers, like all the others, trade on her elected status. And that is the key point. Jackson, Vegh, Scarpitti and the rest are our representatives and should not be able to block us from seeing what they are posting without giving reasons. She says:

“I personally do all my own social media. I don’t even have a staffer. I do my own. It’s me.”

Her comatose Twitter account shows 50 Tweets since July 2018. She has 33 followers. I’m not surprised she doesn’t have a staffer.

She was also against a Code of Conduct.

Richmond Hill’s Joe DiPaola who ran against Carmine Perrelli a few months ago for Mayor of Richmond Hill (both losing to David West) takes a swipe at Perrelli but without mentioning him by name:

“We have councillors that have spent hundreds of thousands of dollars on communications and thousands on boosting posts that get to 80,000 people…90% (of the comments) are deleted or hidden, not shown… It completely distorts what the general public is feeling or what they’d like to comment about. This policy doesn’t even address that.”

DiPaola tells his colleagues that if they are going to block constituents from seeing what they are posting they better have

“a good, valid, justifiable reason for doing so.”

Unfortunately, but entirely predictably, York Regional Council in a 13-8 vote disagrees.

This email address is being protected from spambots. You need JavaScript enabled to view it.

From Newmarket Today on 30 June 2022: York Region politicians reject social media rules for themselves

- Details

- Written by Gordon Prentice

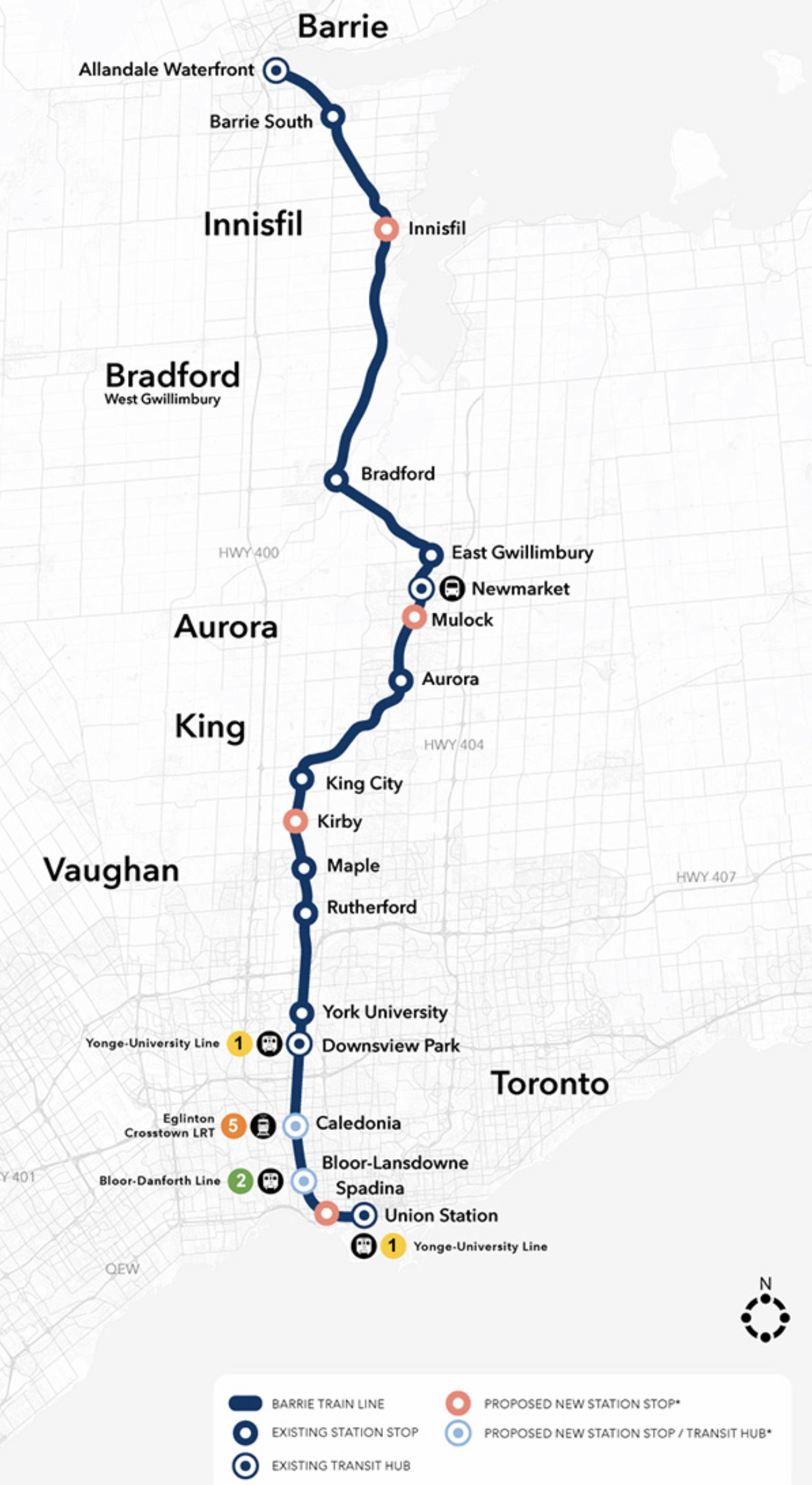

York Region Transportation Master Plan (TMP). updated every 5 years, guides development across the region over the next 30 years.

Although it has just been published and agreed “in principle” (with comments invited from the public by 8 August 2022) it is already out of date.

Just when they were finalising their Transportation Master Plan the very same Regional Council members were making 11th hour amendments to the Regional Official Plan opening up huge areas of Whitebelt land for development. East Gwillimbury to the north of us is going to see more explosive road-based growth in the near to medium term.

Imbalanced

The TMP doesn’t say nearly enough about rail transit but says plenty about new roads and highways. The Plan is seriously imbalanced.

Boxes are ticked. Plans are “aligned” but there is no analysis of the future complementarity of road and rail and how they should mesh together.

Instead, York Region’s transport planners are content to leave rail network policy to Metrolinx when the two of them should be working together, hand in hand.

The end result is that key decisons on road/rail grade separations in Newmarket and points north are, yet again, put off to another day and are “subject to further study”.

Who is going to do the studying? When will they report? Who are they talking to? How much will it all cost? Who will pick up the tab? What are the timelines? We are not told.

A 15-minute service to Bradford: but on what assumptions?

I sent this to York Region’s Director of Transportation and Infrastructure Planning, Brian Titherington, on 27 June 2022:

"I watched with interest the debate on the Regional Transportation Master Plan on 16 June 2022 but was disappointed by the lack of emphasis on rail transit.

You told Regional Councillor Jones that the TMP’s rapid transit map reflects the GO expansion program and that your plan aligns with Metrolinx’s 2041 Regional Transportation Plan for the Greater Toronto and Hamilton Area which was published in May 2018.

That 2041 plan shows an all-day two-way 15-minute service running north from Aurora to Green Lane but things have moved on since the Metrolinx plan was published.

On 22 September 2020 East Gwillimbury Council called on Metrolinx to accelerate the timetable for bringing the 15-minute service north to Green Lane and on 14 August 2021 Metrolinx confirmed that it would be extending the service to Bradford. The agency explained it could do this:

“thanks to further study and optimisation of service plans”

The TMP which was agreed in principle a fortnight ago makes no mention of this.

The original commitment to East Gwillimbury Council, repeated since in Metrolinx statements and press releases, is open-ended with no date being given for implementation but surely it is significant enough to be worthy of a reference.

You told Regional Councillor Jones you had a presentation from Metrolinx in January, and I am assuming the matter was discussed.

Clearly, the Metrolinx commitment to run a 15-minute service to Bradford is contingent on other things happening – electrification, twin tracking, grade separation and so on.

Would it be possible for you to tell me what assumptions Metrolinx made when it told us the Bradford service was possible thanks to further study and optimisation of service plans?

As you know, East Gwillimbury is the fastest growing municipality in Canada and the Region’s Official Plan (approved at the same 16 June meeting) released a further 1,730 acres (or 2.7 square miles) of Whitebelt in East Gwillimbury for development.

In the light of this, it seems to me the Region should be making the case for bringing forward the 15-minute Bradford service, aligning itself with East Gwillimbury Council.

I am copying this to Regional Councillor Jim Jones and to Newmarket Mayor John Taylor.

I look forward to hearing from you."

Comments by 8 August 2022

The 2022 Transportation Master Plan is now open for public comment for a 30-day review period – until Monday, August 8, 2022. Comments can be emailed to Transportation Operations, Public Works at This email address is being protected from spambots. You need JavaScript enabled to view it.

This email address is being protected from spambots. You need JavaScript enabled to view it.

Page 71 of 287